tennis96.ru Tools

Tools

Roth Income Levels

The best answer I've found so far is The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. As long as your money has been in the Roth IRA for at least five years, your qualified distributions are tax-free. · There is no maximum age limit for making. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. Individual Roth IRA limits are restricted based on income levels, whereas the Roth contributions to the TDA Plan are not subject to income limits. Q: What. How is compensation defined for purposes of the Roth IRA contribution limit? Any contribution that is distributed, together with net income, from a Roth IRA. Roth IRA MAGI Limits ; Single or Head of Household. Less than $, Full contribution ; Single or Head of Household · $, – $, Partial contribution. Taxpayers who are married and filing jointly must have incomes of $76, or less in · All head-of-household filers must have incomes of $57, or less in. Your distribution is income tax-free if you are eligible for a distribution Contribution limits – Roth IRA contributions are limited to. $7, in The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. Your personal Roth IRA contribution limit. The best answer I've found so far is The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. As long as your money has been in the Roth IRA for at least five years, your qualified distributions are tax-free. · There is no maximum age limit for making. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. Individual Roth IRA limits are restricted based on income levels, whereas the Roth contributions to the TDA Plan are not subject to income limits. Q: What. How is compensation defined for purposes of the Roth IRA contribution limit? Any contribution that is distributed, together with net income, from a Roth IRA. Roth IRA MAGI Limits ; Single or Head of Household. Less than $, Full contribution ; Single or Head of Household · $, – $, Partial contribution. Taxpayers who are married and filing jointly must have incomes of $76, or less in · All head-of-household filers must have incomes of $57, or less in. Your distribution is income tax-free if you are eligible for a distribution Contribution limits – Roth IRA contributions are limited to. $7, in The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. Your personal Roth IRA contribution limit.

The Roth IRA allows taxpayers with federal adjusted gross income under threshold amounts ($, to $, for joint filers and $95, to $, for. Why does the IRS set income limit on Roth IRA? The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. It prevents highly. ▻ Higher contribution limits than Roth IRAs — plans allow for greater after-tax savings. ▻ Eligibility at all income levels — Unlike Roth IRAs. For , that limit is $, of modified adjusted gross income (MAGI) for someone who is married and files jointly. For single taxpayers, the limit is. The maximum amount you can contribute to a Roth IRA for is $7, (up from $6, in ) if you're younger than age If you're age 50 and older, you. to the IRS limit of $22, (or $30, if they're. 50 years of age or older) to their employer's retirement plan for There are no income limitations. Eligibility for Roth IRA. The account holder must have taxable earned income. There are income limits that determine eligibility. Check out the Roth IRA. A Roth IRA is a special type of retirement account that allows your monetary contributions and interest earnings to grow tax free. Compared to now, do you think you'll be in a higher or lower income tax bracket when you retire? Frequently asked questions. When can you. For Roth IRAs, however, the limits are significantly lower: $6, for those under 50, and $7, for over At higher income levels, those limits decrease. The limit for contributions to traditional and Roth IRAs for is $, plus an additional $ if the taxpayer is age 50 or older. #3: You must stay below income limits to contribute to a Roth IRA If you file taxes as a single person, your modified adjusted gross income (MAGI) must be. Is phased out completely when your income is more than $, if you are Single or Head of Household, or $, if Married Filing Jointly; Married couples. For Roth IRAs, however, the limits are significantly lower: $6, for those under 50, and $7, for over At higher income levels, those limits decrease. The Roth contribution option on a (b) plan has no income limit. Roth (b) Plan Contribution Limits. Limits for Roth contributions are combined with those. For example, for the tax year , a couple filing jointly and reporting less than $, in adjusted gross income may contribute the annual maximum of. For , the limit for overall contributions into a defined contribution plan is $58, (not including catch-up contributions). When the plan allows, after-. The Roth IRA allows for non-deductible contributions up to $5, in (same in ), no matter what your age (provided you have earned income), and. □ Higher contribution limits than Roth IRAs — plans allow for greater after-tax savings. □ Eligibility at all income levels — Unlike with Roth IRAs. The Roth contribution option on a (b) plan has no income limit. Roth (b) Plan Contribution Limits. Limits for Roth contributions are combined with those.

How To Make A Fake Bank Account

The purpose of creating fake accounts can vary, but often it is done in order to engage in fraud or other illegal activities. It can also be done simply to. Get replacement bank statements for Halifax, HSBC, Barclays, Santander, Lloyds and many more. Replica fake bank statements for novelty use. This Online Banking Simulation allows you to see what it is like to manage your own online bank account. Pay bills, transfer funds, and make check deposits. The easiest way for scammers to get access to your mobile bank account is by scamming you. In , the FBI reported that there were almost 65, fake bank. You could get some large Amazon cardboard boxes and drawn them with crayon to look like a bank desk and so on. And then buy some fake money from. If a legitimate job requires you to make money transfers, the money should be withdrawn from the employer's business account. Never provide your bank account. There are several ways hackers can create fake bank accounts. They can register as another individual whose identity, including address, name, signature. When it comes to cyberattacks, details are the most important thing, so it's also a good idea to develop a habit and verify the address of each page before you. Create Fake Bank Account with any amount in checking or savings with statement. “Disclaimer: this app is a prank app for entertainment purposes only and. The purpose of creating fake accounts can vary, but often it is done in order to engage in fraud or other illegal activities. It can also be done simply to. Get replacement bank statements for Halifax, HSBC, Barclays, Santander, Lloyds and many more. Replica fake bank statements for novelty use. This Online Banking Simulation allows you to see what it is like to manage your own online bank account. Pay bills, transfer funds, and make check deposits. The easiest way for scammers to get access to your mobile bank account is by scamming you. In , the FBI reported that there were almost 65, fake bank. You could get some large Amazon cardboard boxes and drawn them with crayon to look like a bank desk and so on. And then buy some fake money from. If a legitimate job requires you to make money transfers, the money should be withdrawn from the employer's business account. Never provide your bank account. There are several ways hackers can create fake bank accounts. They can register as another individual whose identity, including address, name, signature. When it comes to cyberattacks, details are the most important thing, so it's also a good idea to develop a habit and verify the address of each page before you. Create Fake Bank Account with any amount in checking or savings with statement. “Disclaimer: this app is a prank app for entertainment purposes only and.

Criminals will post on social media and other websites to recruit mules to make quick money in exchange for opening a bank account. The scammers will tell the. We use essential cookies to make our site work. With your consent, we may Stop fake account fraud with autonomous, enterprise-grade bot protection. I know there are several pretty-realistic fake banks used for scambaiting (tricking scammers into thinking they're talking with a victim but just wasting their. If we make changes to Erica and/or the Bank of America Online Banking. View Fraud Checklist; Routing & Account Numbers; Account Features. How Do Fraudsters Open Bank Accounts? · 1. They Create Synthetic Identities · 2. They Purchase Pre-Created Accounts · 3. They Spoof Their Configurations · 4. They. This Online Banking Simulation allows you to see what it is like to manage your own online bank account. Pay bills, transfer funds, and make check deposits. Beware of the potential buyer who shows you a screen shot of a bank transfer using the fake apps to wrongly claim money has been transferred to your account. We use essential cookies to make our site work. With your consent, we may Stop fake account fraud with autonomous, enterprise-grade bot protection. If someone you meet online needs your bank account information to deposit money, they are most likely using your account to carry out other theft and fraud. Rules that govern EFT payments will apply if you make an ATM withdrawal, or if you use a debit card (check card), debit card number, or your checking account. You get a check with instructions to deposit it in a personal bank account and wire some of the money to someone else. But once you do, the money is gone and. Fake online pharmacies use the Internet and If you have any doubts at all about the person asking for money, do not give them any cash, credit card or bank. Manipulating bank balances: Changing bank balances is a common tactic used in bank statement fraud. By altering figures to reflect inflated or. Criminals will post on social media and other websites to recruit mules to make quick money in exchange for opening a bank account. The scammers will tell the. and even the bank's logos are modifications we regularly detect. Fraudsters tend to get careless with these details, so it is essential to look out for them. The fastest way to redact Create Fake Chase Bank Statement. create fake chase bank statement online · Register and sign in. Register for a free account, set a. A common thread emerges in such situations: fraudsters capitalize on the crisis to steal money using bogus documents (making fake bank statements online is easy. Most sites make this really easy to do, including your First Commonwealth Online Banking. Log in today, and click on "Settings." More Fraud Resources. Our Fraud. Account verification scams. Scammers create a sense of urgency by sending fake fraud alerts or other messages claiming there's an issue with your account. But. The easiest way to become a victim of a bank scam is to share your banking info — eg, account numbers, PIN codes, social security number — with someone you don.

Binance Interest

Borrow Interest & Cross Margin Limit. Interest History. BNB 5% off. VIP Level: Regular User. 1. 2. 3. 4. 5. 6. 7. 8. 9. No Data. Cross Margin Pro Position Tiers. BNB price live at $, up % in the last 24 hours. Compare the best BNB prices and latest interest rates from leading platforms. Binance staking rewards ; Tether (USDT) · Binance, Up to % APY ; Binance Coin (BNB) · Binance, Up to % APY ; Solana (SOL) · Binance, Up to % APY. Earning interest from digital currencies like Binance coin is considered to be less risky compared to trading in them. When you are trading crypto, you usually. Note: This coin is not listed on Binance for trade and service. Yes, you can set up and use Binance's savings feature to earn interest on your cryptocurrencies. How to set up Binance savings 1. How does Simple Earn work? Simple Earn allows users to earn rewards by depositing their digital assets for either flexible or locked periods of time. Yes, you can set up and use Binance's savings feature to earn interest on your cryptocurrencies. How to set up Binance savings 1. Compound interest refers to the interest accumulated on the principal amount, in addition to the interest from previous periods. Borrow Interest & Cross Margin Limit. Interest History. BNB 5% off. VIP Level: Regular User. 1. 2. 3. 4. 5. 6. 7. 8. 9. No Data. Cross Margin Pro Position Tiers. BNB price live at $, up % in the last 24 hours. Compare the best BNB prices and latest interest rates from leading platforms. Binance staking rewards ; Tether (USDT) · Binance, Up to % APY ; Binance Coin (BNB) · Binance, Up to % APY ; Solana (SOL) · Binance, Up to % APY. Earning interest from digital currencies like Binance coin is considered to be less risky compared to trading in them. When you are trading crypto, you usually. Note: This coin is not listed on Binance for trade and service. Yes, you can set up and use Binance's savings feature to earn interest on your cryptocurrencies. How to set up Binance savings 1. How does Simple Earn work? Simple Earn allows users to earn rewards by depositing their digital assets for either flexible or locked periods of time. Yes, you can set up and use Binance's savings feature to earn interest on your cryptocurrencies. How to set up Binance savings 1. Compound interest refers to the interest accumulated on the principal amount, in addition to the interest from previous periods.

Interest rates can refer either to the cost of borrowing money or the return earned on an investment, usually expressed as a percentage of the principal. No matter the crypto market movement, crypto deposits allow you to earn steadily. While our savings account example had 5% interest compounded annually, you can. A safe and convenient way for Binance Coin investors to securely loan out their BNB tokens to borrowers and earn passive income in return. Compound interest, the process of earning interest on your reinvested earnings, can significantly accelerate the growth of your investment. With EarnPark, your. BNB (Binance Coin): Binance Coin staking can yield rates from 1% to 20% APY. It depends on the specific staking program chosen; USDT (Tether): Stablecoins like. Binance (Futures) 24h trading volume is reported to be at $36,,,, a change of % in the last 24 hours, and the 24h open interest. BTC Open Interest on Binance exchange - BTCUSDT contract: tradingview chart, real time, historical data, multiple timeframes. Compare with contract price. Holding #Bitcoin or $USDT? You could be earning interest literally every day. $USDT - 5% APY #BTC - 3% APY It's flexible savings. Binance provides a crypto wallet for traders to store their electronic funds. The exchange has supporting services for users to earn interest or transact using. Why does Binance offer such high interest on USDT? Stablecoins. I saw on their website that they are giving 19+7% (first ) interest, what's. Crypto Trading Data - Get the open interest, top trader long/short ratio, long/short ratio, and taker buy/sell volume of crypto Futures contracts from. In it you earn popular coins via competitive interest rates by staking BTC, BNB, etc. Binance Savings is a financial product that allows you to. Binance BTC Futures Open Interest (USD) What is bitcoin open interest? Bitcoin open interest refers to the total number of outstanding Bitcoin futures or. Binance provides a crypto wallet for traders to store their electronic funds. The exchange has supporting services for users to earn interest or transact using. interests. Together, the staking rewards and slashing mechanisms help maintain the security, integrity, and operations of blockchain networks. At tennis96.ru How to pull Open Interest (Futures) data from Binance into Excel and Google Sheets. interest, funding rate, and more. With this page, you can gain a deeper Binance. Volume Open Interest. BTC. $B. ETH. $B. SOL. $B. Therefore, if you want to maximize profits from crypto staking, Binance locked terms are the better option. To give you an example of the interest rates at the. For earning yield, staking BNB is sometimes used interchangeably with lending BNB. So those looking for the best BNB staking rates to earn interest might be.

Cash Back Cards With No Foreign Transaction Fee

Compare benefits and start earning travel rewards today with one of Citi's no foreign transaction fee credit cards. 4 % |or 3 % Cash Back. Earn 4% on eligible. Earn unlimited % cash back with every purchase · No annual fee · No international transaction fees · Redeem your cash back anytime with no minimum · Contactless. Earn unlimited % cash back on every purchase, every day; $0 annual fee and no foreign transaction fees; Earn unlimited 5% cash back on hotels and rental. No Annual Fee Credit Cards ; Chase Freedom Unlimited credit card · Earn a $ bonus · Unlimited % cash back is just the beginning. ; Chase Freedom Flex Credit. 2% cash back per dollar spent · No foreign transaction fees · Includes elite travel rewards and Visa Signature perks · New cardholders receive 7, bonus points. KOHO credit card, FX fee: % Annual fee: $ (charged at $9 per month) Features: % cash back on groceries, transportation, food, and drink. Capital One Quicksilver is % cash back with no foreign transaction fee. Fidelity Visa is 2% cash back with a 1% foreign transaction fee, so. Best for students: Bank of America® Travel Rewards credit card for Students Here's why: Decent travel rewards plus no foreign transaction fee plus no annual. “Bank of America's Travel Rewards card is pretty good with no foreign transaction fee. I've used it frequently in Canada and the spot rate is way. Compare benefits and start earning travel rewards today with one of Citi's no foreign transaction fee credit cards. 4 % |or 3 % Cash Back. Earn 4% on eligible. Earn unlimited % cash back with every purchase · No annual fee · No international transaction fees · Redeem your cash back anytime with no minimum · Contactless. Earn unlimited % cash back on every purchase, every day; $0 annual fee and no foreign transaction fees; Earn unlimited 5% cash back on hotels and rental. No Annual Fee Credit Cards ; Chase Freedom Unlimited credit card · Earn a $ bonus · Unlimited % cash back is just the beginning. ; Chase Freedom Flex Credit. 2% cash back per dollar spent · No foreign transaction fees · Includes elite travel rewards and Visa Signature perks · New cardholders receive 7, bonus points. KOHO credit card, FX fee: % Annual fee: $ (charged at $9 per month) Features: % cash back on groceries, transportation, food, and drink. Capital One Quicksilver is % cash back with no foreign transaction fee. Fidelity Visa is 2% cash back with a 1% foreign transaction fee, so. Best for students: Bank of America® Travel Rewards credit card for Students Here's why: Decent travel rewards plus no foreign transaction fee plus no annual. “Bank of America's Travel Rewards card is pretty good with no foreign transaction fee. I've used it frequently in Canada and the spot rate is way.

Earn a flat % cash back on all eligible purchases with no annual fee or foreign transaction fees with the Citizens Cash Back Plus™ World Mastercard®. Sign-Up Bonus Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you've earned at the. We think the Bank of America Travel Rewards credit card is an excellent choice for international travelers. It has a $0 annual fee with 0% foreign transaction. Explore Capital One credit card benefits. · No Foreign Transaction Fees. You won't pay a transaction fee when making a purchase outside of the United States. Credit cards with no foreign transaction fees give you the freedom to spend internationally without the added cost. Fees* Note: View the Preferred Cash Rewards Visa® Signature Credit Card Rates and Fees. No Annual Fee. No Foreign Transaction Fees. Balance Transfer and Cash. Choose the credit card that suits your lifestyle. Enjoy 3X Points on most travel purchases, airport lounge access and no foreign transactions fees. 33 partner offers · Capital One SavorOne Cash Rewards for Good Credit · Marriott Bonvoy Brilliant American Express Card · Capital One Venture X Rewards Credit Card. Capital One VentureOne Rewards Credit Card · Sign Up Bonus 20, Miles once you spend $ on purchases within 3 months from account opening · Rewards Rate The best one out there right now is the KOHO Extra Mastercard – and it has no foreign transaction fees. KOHO Extra Mastercard. Up to % cash back on purchases. Travel outside the U.S. and make purchases with $0 foreign transaction fees when using these Chase credit cards. Apply online today. Capital One VentureOne Rewards Credit Card. The Capital One VentureOne Rewards Credit Card is the best no-annual-fee travel card without foreign transaction. No foreign transaction fee Say adios to foreign transaction fees and bonjour to great travel benefits like emergency card replacement, emergency cash. When you spend on these categories, you can earn 1% or 3% depending on the card you choose. Fee vs No-Fee Credit Cards: Not all TD cash back credit cards offer. Enjoy no annual fee and no foreign transaction fees while earning points to use for a statement credit to pay for flights, hotel stays, vacation rentals. Cash Back; Rewards Points; No Annual Fee; 0% Intro APR; No Foreign Transaction Fee; Airline; Hotel; Balance Transfer. Travel Rewards Cards (12). Travel Rewards. Which credit card is right for you? · No caps on how much you can earn · No cash back expiration dates to worry about · No foreign transaction fees*. One of the best cash back credit cards with no foreign transaction fee is the Capital One SavorOne Cash Rewards Credit Card. This card offers 1 - 8% cash. No Annual Fee Cards (5) · Blue Cash Everyday Card from American Express · No Annual Fee · No Annual Fee · Cash Magnet Card · No Annual Fee · No Annual Fee · Amex. With a comprehensive list of travel benefits that work alongside your no foreign transaction fee benefit and a great reward program, this card is recommended.

What Is A Master Limited Partnership

MLPs engage in active businesses, primarily in the energy industry. There are a number of publicly traded partnerships which are not active businesses and are. Master Limited Partnership is a limited partnership that is traded on the public exchanges just like corporate stock. A share in an MLP is called a “unit,”. A master limited partnership (MLP) or publicly traded partnership (PTP) is a publicly traded entity taxed as a partnership. Master limited partnerships are risky investments associated with the oil and gas industry. Contact our attorneys if you have suffered investment losses as. Experienced Attorneys Offering Legal Services Nationwide. If you have suffered financial losses as an investor for oil and gas master limited partnerships (MLPs). This is a benefit since this allows the. MLP to either internally invest more capital than it otherwise could to grow its operations or pay a higher cash. • Simply, it is a partnership, or a limited liability company. (LLC) that has chosen partnership taxation, that trades on a public exchange (NYSE, NASDAQ, etc. A typical master limited partnership consists of publicly traded common units held by limited partners, a general partner interest, and incentive distribution. A master limited partnership (MLP) is a type of business venture that exists in the form of a publicly traded limited partnership. MLPs engage in active businesses, primarily in the energy industry. There are a number of publicly traded partnerships which are not active businesses and are. Master Limited Partnership is a limited partnership that is traded on the public exchanges just like corporate stock. A share in an MLP is called a “unit,”. A master limited partnership (MLP) or publicly traded partnership (PTP) is a publicly traded entity taxed as a partnership. Master limited partnerships are risky investments associated with the oil and gas industry. Contact our attorneys if you have suffered investment losses as. Experienced Attorneys Offering Legal Services Nationwide. If you have suffered financial losses as an investor for oil and gas master limited partnerships (MLPs). This is a benefit since this allows the. MLP to either internally invest more capital than it otherwise could to grow its operations or pay a higher cash. • Simply, it is a partnership, or a limited liability company. (LLC) that has chosen partnership taxation, that trades on a public exchange (NYSE, NASDAQ, etc. A typical master limited partnership consists of publicly traded common units held by limited partners, a general partner interest, and incentive distribution. A master limited partnership (MLP) is a type of business venture that exists in the form of a publicly traded limited partnership.

A master limited partnership is a publicly-traded company that operates as a limited partnership. That is, it is a pass-through entity for tax purposes and is. master limited partnership, or MLP. Master limited partnership is the term applied to limited partnerships traded on organized securities exchanges. MLPs. In addition to The Book of Jargon®: MLPs (Master Limited Partnerships),. Latham & Watkins has launched the MLP Portal at tennis96.ru This online resource. PwC has been advising clients on successfully structuring their Master Limited Partnership (MLP) and taking it public. A master limited partnership is a publicly-traded business venture that combines the features of a corporation with that of a partnership and exists as a. A master limited partnership (MLP) is also sometimes known as a publicly traded partnership (PTP). It's a limited partnership that's traded publicly on an. MLPs and similar partnership investments are subject to complex tax rules. An MLP is taxed as a partnership and generates. Schedule K-1 (Form ) (referred to. How are partnerships, including. MLPs, taxed? Even though MLP investments are often referred to as stocks, they are in fact investments in a partnership. Master Limited Partnerships (MLPs) Expert Witnesses. Master Limited Partnerships (MLPs) expert witnesses may be an integral component of litigation pertaining. Overview. A master limited partnership (MLP), also known as a publicly traded partnership, is a limited partnership or limited liability company that is. MLPs capitalize on the tax advantages of investing in a limited partnership with the liquidity of a publicly traded company. MLPs are pass-through entities that are taxed as a partnership for federal income tax purposes, avoiding the double taxation of corporations (see Practice Note. What is a Master Limited Partnership (MLP)? Master limited partnerships (MLPs) can offer high dividend yields, steady cash flow, tax advantages, and the. We offer legal services for Master Limited Partnerships (MLPs) and underwriters in essentially all the industries in which they operate. Baird has prepared this document to help you understand the characteristics and risks associated with an investment in securities of a master limited. How master limited partnerships work An MLP is a business structure that is taxed as a partnership, but whose ownership interests are traded like corporate. An MLP's limited partnership agreement (the “LPA”) will contain a provision providing for an allocation of quarterly cash distributions among the classes of. In a low interest rate environment, many financial professionals sell Master Limited Partnerships to their customers. Many MLPs have been wrongly sold as a. MLPA is the nation's only trade association representing the publicly traded partnerships commonly known as master limited partnerships (MLPs). Master limited partnerships are intended for very experienced investors who understand both the risks involved and the incredibly complex taxation rules. Please.

Qualifying Dividends Tax Rate

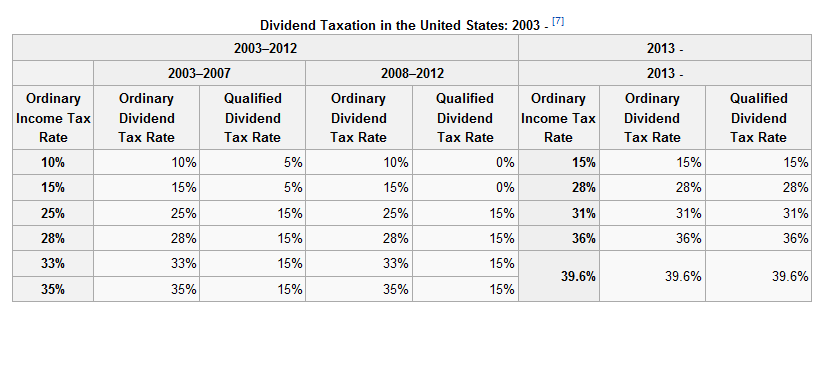

What is a dividend? · In the 10% or 12% tax bracket, your qualified dividends are taxed at 0%, · In the 22%, 24%, 32%, or 35% tax bracket, your qualified. However, the law currently permits the taxation of "qualified dividend income" at the same rate as capital gain income (section 1(h)(11) of the Code). For However, "ordinary dividends" (or "nonqualified dividends") are taxed at your normal marginal tax rate. Subscribe to Kiplinger's Personal Finance. Be a smarter. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Dividends received from a publicly listed company are taxable at the same withholding tax rate as those received from a private company, i.e. 5% for a. Taxable distributions from the earnings and profits of money market or mutual funds and investment trusts and companies must be reported as dividend income, not. To lower your tax rate on income, consider owning investments that pay qualified dividends. These dividends are federally taxable at the capital gains rate. If the dividend is qualified, they face a 15% tax rate (using the qualified dividend tax rate table above), resulting in a $15 tax obligation ($ x 15%). If. Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously. What is a dividend? · In the 10% or 12% tax bracket, your qualified dividends are taxed at 0%, · In the 22%, 24%, 32%, or 35% tax bracket, your qualified. However, the law currently permits the taxation of "qualified dividend income" at the same rate as capital gain income (section 1(h)(11) of the Code). For However, "ordinary dividends" (or "nonqualified dividends") are taxed at your normal marginal tax rate. Subscribe to Kiplinger's Personal Finance. Be a smarter. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Dividends received from a publicly listed company are taxable at the same withholding tax rate as those received from a private company, i.e. 5% for a. Taxable distributions from the earnings and profits of money market or mutual funds and investment trusts and companies must be reported as dividend income, not. To lower your tax rate on income, consider owning investments that pay qualified dividends. These dividends are federally taxable at the capital gains rate. If the dividend is qualified, they face a 15% tax rate (using the qualified dividend tax rate table above), resulting in a $15 tax obligation ($ x 15%). If. Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously.

Some (but not all) dividends are eligible for a qualified tax rate, typically at one's capital gains rate. So, what makes a dividend qualified? There are. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are reported to the estate or trust in box 1b of. Nonqualified dividends are taxed at the investor's ordinary income tax rate up to 37%. Many taxpayers fall within the 22% or 24% tax brackets, which are higher. Now, qualified dividends for investors with incomes over those figures will be taxed at a 20% rate (same goes for capital gains tax rates). Unqualified. The tax rates for ordinary dividends are the same as standard federal income tax rates: 10% to 37%. Qualified Dividends vs. Ordinary Dividends. A dividend is a. Unlike many foreign countries in which dividend income is either tax-free or tax-exempt — the United States taxes foreign income, although the tax rate may be. It is a tax on interest and dividends income. Please note that the I&D Tax is being phased out. The tax rate is 5% for taxable periods ending before December To lower your tax rate on income, consider owning investments that pay qualified dividends. These dividends are federally taxable at the capital gains rate. The dividends received deduction (DRD) is increased from 50% to 65% if the recipient of the dividend distribution owns at least 20% but less than 80% of the. Qualified dividend income is taxed at rates of 0%, 15%, or 20% depending on your taxable income, as shown in the table below. See the IRS Form instructions. Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower. View Vanguard funds and their net income eligible for a reduced tax rate as qualified dividend income (QDI). Individual shareholders generally pay tax on qualified dividends at long-term capital gains rates. Qualified dividends are dividends that are paid from either. Qualified Dividends ; Ordinary Income Tax Rate. Qualified Dividend Income Tax Rate ; 10%. 0% ; 15%. 0% ; 25%. 15% ; 28%. 15%. And that's still true. However, compensation can now be taxed to individual owners at federal rates up to 37%, while qualified dividends are taxed as high as The tax rates for qualified dividends range from 0% to 20% based on your income level. • Holding period requirements must be met for dividends to be considered. A “qualified dividend” is a dividend paid by a company on its stock and that is taxable by the IRS at a lower rate than the income tax rate that some taxpayers. Background Information on the 15% Tax Rate on Qualified Dividends. Definitive information on the new lower taxes on dividends is impossible to come by at the. A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that. What Is the Qualified Dividend Tax Rate? The qualified dividend tax rate for tax year — filing in — is either 0%, 15% or 20%. These rates are.

Where To Invest 100k For 6 Months

Notice how the fees affect the investment portfolio over 20 years. Portfolio Value From Investing $, Over 20 Years. Page 2. Investor Assistance (). Calculate how much money you need to contribute each month in order to arrive at a specific savings goal Amount of money you have readily available to invest. Park your cash in an interest-bearing savings account · Max out contributions to retirement accounts · Invest in ETFs · Buy bonds · Consider alternative investments. Revenue Marketing | Demand Generation | Mentor. Published Sep 6, + invest early in a condo (my primary residence) within 18 months of accumulating enough savings for the down-payment. So, my net worth. Chad U. Investor; Boca Raton, FL. Replied 6 months ago. Buy Bitcoin. 1 Vote · Log If that $k investment threshold is something you've come across. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! Another great way to invest $45, is to invest in a private real estate fund from Fundrise, my favorite private real estate investing platform. For most. The lowest month return was % (March to March ). Savings accounts at a financial institution may pay as little as % or less but carry. Investing in real estate, peer-to-peer lending, and stocks are some of your options. Notice how the fees affect the investment portfolio over 20 years. Portfolio Value From Investing $, Over 20 Years. Page 2. Investor Assistance (). Calculate how much money you need to contribute each month in order to arrive at a specific savings goal Amount of money you have readily available to invest. Park your cash in an interest-bearing savings account · Max out contributions to retirement accounts · Invest in ETFs · Buy bonds · Consider alternative investments. Revenue Marketing | Demand Generation | Mentor. Published Sep 6, + invest early in a condo (my primary residence) within 18 months of accumulating enough savings for the down-payment. So, my net worth. Chad U. Investor; Boca Raton, FL. Replied 6 months ago. Buy Bitcoin. 1 Vote · Log If that $k investment threshold is something you've come across. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! Another great way to invest $45, is to invest in a private real estate fund from Fundrise, my favorite private real estate investing platform. For most. The lowest month return was % (March to March ). Savings accounts at a financial institution may pay as little as % or less but carry. Investing in real estate, peer-to-peer lending, and stocks are some of your options.

PNC Investment's Emergency Fund Calculator tool will forecast how much you PNC recommends that you consider keeping at least months of your. before you invest. If you decide to buy stock in a new or small company, only diversifying. Get the facts. It's your money. It's your future. Page 2. 6. CD guideBest CD ratesBest 3 month CD ratesBest 6 month CD ratesBest 1 year When you invest in the stock market, you don't earn a set interest rate. 6 minute read. •. April 21, Investing strategies. Managing portfolios three equal parts and investing each one a month apart). The investment is assumed to be % equity. 1. Stocks– Buy individual stocks or ETFs for growth. · 2. Bonds – Government or corporate bonds for steady returns. · 3. Real Estate– Invest in REITs or. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. These calculators are only intended to give you an idea of what your investment could be worth based on the assumptions you make. investments. Find a Put your money to work. With a Mountain America certificate, you set aside funds for a set period of time—between 6 to 60 months. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! These calculators are only intended to give you an idea of what your investment could be worth based on the assumptions you make. 6 months. Isbank UK. United Kingdom. Max. £85, + £1, View details. Details Where to invest £k. To determine the best asset to invest in, you'll. Calculate the effects of inflation on investments and savings. The results shown are intended for reference only, and do not necessarily reflect results that. Investing in a CD can provide peace of mind whether you're saving for Over 12 months through 24 months, the penalty is 6 months' interest, or; Over. Investment Calculator. Investment Month. January, February, March, April, May, June, July, August, September, October, November, December. Investment Day. 1, 2. $50, to $, PRIME + %; $, to $, PRIME + Footnote 6. There are costs associated with owning a mutual fund, such as. First investment - £k: Hi All, I recently sold a property and wish to invest the £k proceeds. I became interested in investing 6 months ago and have. Whether you have a single lump sum to invest or you want to build your pot month by month, this calculator can show your potential returns over time. Choose how. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. The balance tiers are $20, for the Gold tier, $50, for the Platinum tier, $, 14 Merrill Guided Investing 6-Month Offer Introductory 6-Month. Whether you have a single lump sum to invest or you want to build your pot month by month, this calculator can show your potential returns over time. Choose how.

Tickmill Broker

The Tickmill Group is an award-winning, multi-regulated broker that provides access to a wide range of CFD asset classes, including Forex, Stocks, Indices. Tickmill is a broker established in , operating out of its offices in the UK, Cyprus, South Africa, Malaysia, and the Seychelles. Trade & invest with Tickmill. Reviews by verified customers, latest terms & conditions for accounts, research ideas & scripts posted by brokers. Tickmill is a multi-asset broker offering one of the lowest forex commissions out there. The account opening is quick and easy. Tickmill (✓) is young broker founded in It is offering services in ECN NDD model. It is regulated among others by the FCA. The Tickmill Group is an award-winning, multi-regulated broker (FCA, CySEC, FSA, FSCA, Labuan FSA) with a product offering spanning CFDs on Forex, Stocks. Review the forex broker profile of Tickmill to check out the trading conditions, company details, and real-time spreads in this always-updated guide. Tickmill is a reputable and client-focused brokerage, offering a range of trading instruments, secure and efficient payment options. It has a strong focus on. Tickmill offers trading in forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options, and provides clients with two choices of trading. The Tickmill Group is an award-winning, multi-regulated broker that provides access to a wide range of CFD asset classes, including Forex, Stocks, Indices. Tickmill is a broker established in , operating out of its offices in the UK, Cyprus, South Africa, Malaysia, and the Seychelles. Trade & invest with Tickmill. Reviews by verified customers, latest terms & conditions for accounts, research ideas & scripts posted by brokers. Tickmill is a multi-asset broker offering one of the lowest forex commissions out there. The account opening is quick and easy. Tickmill (✓) is young broker founded in It is offering services in ECN NDD model. It is regulated among others by the FCA. The Tickmill Group is an award-winning, multi-regulated broker (FCA, CySEC, FSA, FSCA, Labuan FSA) with a product offering spanning CFDs on Forex, Stocks. Review the forex broker profile of Tickmill to check out the trading conditions, company details, and real-time spreads in this always-updated guide. Tickmill is a reputable and client-focused brokerage, offering a range of trading instruments, secure and efficient payment options. It has a strong focus on. Tickmill offers trading in forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options, and provides clients with two choices of trading.

Tickmill Forex Broker Deposit & Withdraw TICKMILL BROKER REVIEW [ENG SUBs] #Forexindia #tickmill. Forex Salary · · Tickmill Forex Broker How to Open. International traderssince Tickmill services entity through Seychelles as well as other entities, clients with an account opened under this jurisdiction can. In a FAST-MOVING Market, choose a STABLE BROKER · Tickmill Introduction. · Where are Tickmill servers located? · Why TRADE with NextPointHost X-connect to Tickmill. TICKMILL Seychelles is a Forex broker regulated by FSA SC. The company emerged when Armada Markets, an Estonia-based broker, was re-structured in I'm seeing commercials for tickmill, EU regulated broker. Anyone has any thoughts or experience? I'm planing on swing trading, small amounts, fractional. Tickmill is one of the oldest and most reliable ECN brokers, providing services of Internet trading. Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the Financial Conduct Authority (FCA) and the FSA of Seychelles. Tickmill. Tickmill is a regulated online trading platform that has been operating since Headquartered in the Seychelles, the broker has established a strong. Tickmill is a reputable and client-focused brokerage, offering a range of trading instruments, secure and efficient payment options. It has a strong focus on. Tickmill broker offers a safe platform with a huge variety of tradable assets. Start trading and enjoy different bonuses to increase your winnings. Tickmill is not a market maker, it does not operate its own dealing desk. If you have an account at Tickmill, your trades will be routed to liquidity providers. Tickmill is a regulated offshore broker that provides brokerage services to clients worldwide. The broker is known for its focus on innovative trading solutions. Tickmill is the new way of trading with extremely low market spreads, no-requotes, STP and DMA, absolute transparency and the latest trading technology. Tickmill is a global forex and CFD broker that specialises in offering financial services to private and institutional clients. Founded in , the company has. Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the Financial Conduct Authority (FCA) and the FSA of Seychelles. Tickmill. Tickmill is a global Forex and CFD broker, offering trading services with a prime focus on CFDs on Forex, Stock Indices, Commodities and Bonds. Tickmill offers more than 60 currency pairs and CFDs on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies. Full listing profile: Tickmill broker profile. Is Tickmill safe? Investor protection: UK Financial Services Compensation Scheme (FSCS); Regulation: FCA UK. Tickmill offers more than 60 currency pairs and CFDs on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies. Reasons to Use TraderSync as your Main Trading Journal for Tickmill? · Works with + Brokers · Trusted by Professional Traders · Seamless Integration with.

Phone Keylogger Iphone

Keyloggers are silent watchers, waiting to snoop on important information like credentials or bank details. They're also popular with suspicious partners. Keylogger software is also available for use on smartphones, such as the Apple iPhone and Android devices. - GitHub - king04aman/KeyLogger: A keylogger. Easily monitor every keystroke made on an iPhone from the comfort of any remote location. icon Available for all Android and iOS devices. This post motivates and describes an attack where accelerometer/gyroscope readings and machine learning are used to develop a keylogger for mobile devices. This post motivates and describes an attack where accelerometer/gyroscope readings and machine learning are used to develop a keylogger for mobile devices. AnyControl is one of the world's top cell phone keylogger apps for Android and IOS. It is designed to help parents stop potentially dangerous interactions. With. An Android keylogger is a program that runs in the background of your device, keeping track of the keystrokes you use on your phone or tablet. The keylogger can. FlexiSPY is the best keylogger for Android and iPhone, because it can record every stroke that is typed into our supported applications. So the phone is being also used as a listening device. There might also be a separate gps tracker in my car. Could you help me to figure it. Keyloggers are silent watchers, waiting to snoop on important information like credentials or bank details. They're also popular with suspicious partners. Keylogger software is also available for use on smartphones, such as the Apple iPhone and Android devices. - GitHub - king04aman/KeyLogger: A keylogger. Easily monitor every keystroke made on an iPhone from the comfort of any remote location. icon Available for all Android and iOS devices. This post motivates and describes an attack where accelerometer/gyroscope readings and machine learning are used to develop a keylogger for mobile devices. This post motivates and describes an attack where accelerometer/gyroscope readings and machine learning are used to develop a keylogger for mobile devices. AnyControl is one of the world's top cell phone keylogger apps for Android and IOS. It is designed to help parents stop potentially dangerous interactions. With. An Android keylogger is a program that runs in the background of your device, keeping track of the keystrokes you use on your phone or tablet. The keylogger can. FlexiSPY is the best keylogger for Android and iPhone, because it can record every stroke that is typed into our supported applications. So the phone is being also used as a listening device. There might also be a separate gps tracker in my car. Could you help me to figure it.

iPhone Keylogger App: Keep Track of Every Word Typed – Moniterro. Start monitoring. They type, you monitor. See every keystroke they make remotely. Keyloggers for iPhone devices allow you to monitor every keystroke entered by the end-user, but there are software solutions that come with far more features. iPhone keylogger helps the user to see things as they are. iPhones are sophisticated versions of devices. You can efficiently find about the keystroke recorder. The parental control app has the best keylogger feature that allows you to track underage kids. It monitors every keystroke made on the target phone. Track. Are you looking for an iPhone keylogger? In this video, we have listed the best keylogger for iPhone that works. These iOS keyloggers will. Keylogger software is also available for use on smartphones, such as the Apple iPhone and Android devices. - GitHub - king04aman/KeyLogger: A keylogger. iKeyMonitor, the iOS Keylogger for iPhone and iPad that logs keystrokes, passwords, websites and captures screenshots, provides users with detailed guide about. Call Log History. Monitor when calls are made, received and missed by the iOS device. See call duration, time of call and phone numbers. Nevertheless, keylogging an iPhone is possible, in particular for the jailbroken device. Many apps for parental control and phone monitoring, like mSpy or EyeZy. 1. iKeyMonitor · 2. FlexiSPY · 3. Highster Mobile · 4. OverWatch · 5. mSpy · 6. Eyezy · 7. uMobix. SPYERA is an example of a keylogger that can be installed on an iPhone. It is one of the few keyloggers designed to work with iPhones, capturing all keystrokes. Phone Keylogger App for Android. If they type it, you'll see it. That's the power of the world's top cell phone keylogger for Android. What Is A Keylogger For Android And iPhone? In addition to our computer keylogger, FlexiSPY offers a Keylogger for Android and Keylogger for iPhone. These. Install uMobix on a target Android device, or provide iCloud credentials of a target iOS device in your user account. Monitor. Go to your account and wait until. FlexiSPY is the best keylogger for Android and iPhone, because it can record every stroke that is typed into our supported applications. The Phonsee app is one of the most popular keyloggers for iPhone that records everything, such as deleted text, search terms, messages, passwords, login. All features. keylogger for windows. Hoverwatch Keylogger for Windows. The free keylogger function of. Keylogging is an activity where a script or a device registers the keys you pressed or tapped on your keyboard with an intention of storing it or sending on a. Android MOBILE PHONE TRACKING AND special FEATURES · SMS Records all incoming/outgoing SMS messages with phone number and recipient name. · Keylogger Kidlogger.

Direct Store Distribution

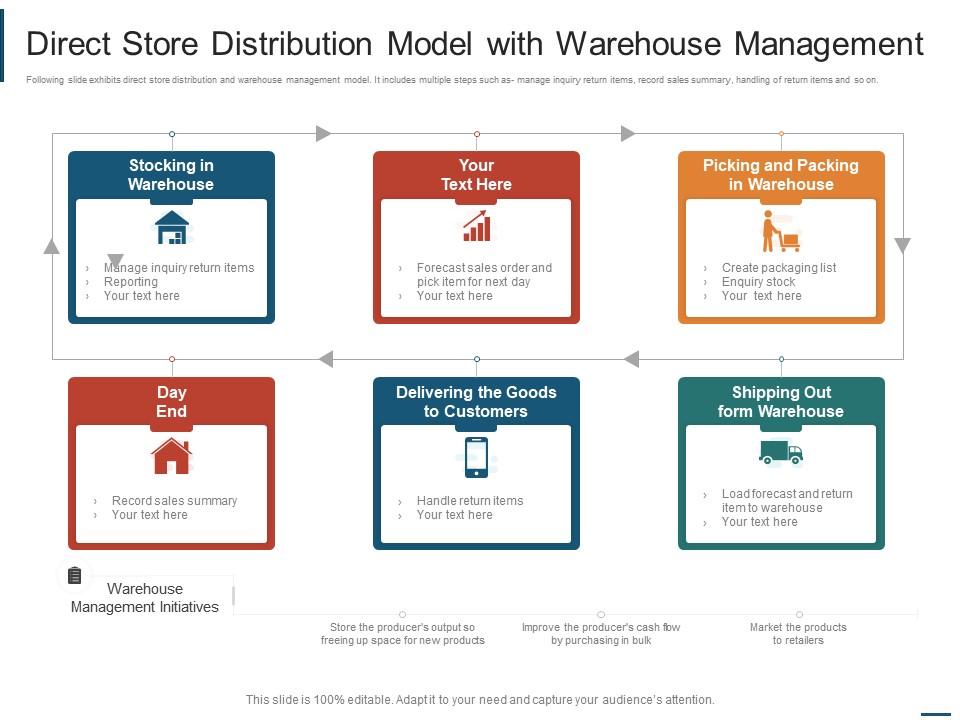

Your complete distribution services include direct store delivery or cash & carry pick up locations, as well as logistics services. DIRECT STORE DELIVERY (DSD). Usually the first option that small growers and food manufacturers choose is DSD (Option 2), and it is usually done for case. Direct store delivery is a somewhat self-explanatory term. DSD bypasses the retailer's distribution center and delivers a brand's goods directly to the store. It also includes strategic decisions regarding the selection of distribution channels, such as direct store delivery (DSD), third-party logistics (3PL), or. A direct-store delivery (DSD) model refers to the process of shipping products directly from a manufacturer or supplier facility to the customer's retail. The Power of DSD: Direct Store Delivery (DSD) is the term used to describe a method of delivering products from a supplier/distributor directly to a retail. DSD is a distribution model that allows manufacturers to deliver their products directly to retail stores, bypassing a centralized distribution center. Direct store deliveryis basically in two ways: delivery to the point of sales and delivery to the point of consumption. Delivery to the point of sales means the. We provide direct to store distribution services to all of our clients that request it. That means we provide product delivery directly to each store location. Your complete distribution services include direct store delivery or cash & carry pick up locations, as well as logistics services. DIRECT STORE DELIVERY (DSD). Usually the first option that small growers and food manufacturers choose is DSD (Option 2), and it is usually done for case. Direct store delivery is a somewhat self-explanatory term. DSD bypasses the retailer's distribution center and delivers a brand's goods directly to the store. It also includes strategic decisions regarding the selection of distribution channels, such as direct store delivery (DSD), third-party logistics (3PL), or. A direct-store delivery (DSD) model refers to the process of shipping products directly from a manufacturer or supplier facility to the customer's retail. The Power of DSD: Direct Store Delivery (DSD) is the term used to describe a method of delivering products from a supplier/distributor directly to a retail. DSD is a distribution model that allows manufacturers to deliver their products directly to retail stores, bypassing a centralized distribution center. Direct store deliveryis basically in two ways: delivery to the point of sales and delivery to the point of consumption. Delivery to the point of sales means the. We provide direct to store distribution services to all of our clients that request it. That means we provide product delivery directly to each store location.

The defining characteristic of the direct market however is non-returnability: unlike book store and news stand distribution, which operate on a sale-or-return. Norman Distribution is a Full-Service DSD Distribution Company specializing in “Better-for-you” Snack, Beverage, and Grocery Products. CAPABILITIES · FACILITIES · FLEET · INNOVATIVE TECHNOLOGY DIRECT STORE DELIVERY (DSD) SOFTWARE: · ELECTRONIC DATA INTERCHANGE. There are two types of distribution channels: direct and indirect. As the names imply, direct distribution is a direct sale between the manufacturer and the. A DSD network bypasses the retailer/wholesaler distribution network with goods moving directly from the point of production/distribution to the stores. Direct store delivery (DSD) does exactly what it says. It's the distribution method whereby products are delivered straight from the supplier (or their partner. We offer multiple service methods such as Direct Store Delivery (DSD), Direct Store Service (DSS) and 3rd party distribution centers. We also specialize. DSD Software For Optimizing Wholesale Distribution. Our dsd software removes manual error in logistics and builds optimized sales routes for distributors' reps. Direct distribution means you take responsibility for delivering your goods into the hands of consumers. Many small business owners who are just launching their. Direct store delivery, or DSD, is a replenishment strategy that bypasses the traditional distribution network of shipping from a manufacturing plant to a. Our Direct Store Delivery (DSD) software solution empowers businesses to experience unparalleled efficiency by optimizing outdated processes. It eliminates. In order to control supply chain costs, and following digital trends, manufacturers and retailers are ready to replace traditional delivery. Courteous Delivery Driver & Merchandisers visit your store on a scheduled basis to service and defrost your freezers and merchandise product and place POS. Cold Front's Direct Store Delivery model is particularly suited for retail shops that require frequent replenishment and for companies that need tight delivery. A direct distribution channel allows consumers to buy and receive goods directly from the manufacturer. An indirect channel moves products from the. For example, a company that manufactures clothes and sells them directly to its customers using an e-commerce platform is utilizing a direct distribution. We guarantee profit margins of %. Our minimum order requirement is a very reasonable $ per delivery. Shipping available direct to businesses, direct to consumers, or distribution; LTL, FTL, and parcel service offered with nationally-competitive rates. Managing your direct store delivery business is like juggling nine different balls at once. Operations, route sales, service, inventory, building displays. If DSD is part of your distribution strategy, we seamlessly process your goods directly to retail stores, bypassing traditional distribution centers or.

1 2 3 4 5 6